Insights From HPE’s 2025 Securities Analyst Meeting

Technology buyers should look at how vendors communicate with investors and securities markets to gain technology market insights and to see how the vendor sees their place in the market. Whether it be a securities analyst meeting or SEC filings, particularly 10-K annual reports, you can often get insights into the vendor.

Cut through the hype of conference product announcements and sales presentations and get pragmatic, often conservative guidance about where the vendor sees risks and opportunities in technology markets and where they expect to see growth and target segments of the market.

There was a lot to digest in the annual HPE securities analyst meeting as the executives addressed the three core pillars of the business – networking, cloud, and AI – as well as a lot of financial guidance and projections. While this research note will focus on HPE Networking, the networking business overlaps with cloud and AI as well. The highlights included:

- Networking is now HPE’s growth and profit anchor. HPE Networking is expected to represent ~60% of non-GAAP consolidated operating profit by 2028, up from the current ~50%. HPE set a conservative networking long‑term revenue compound annual growth rate (CAGR) target of 5-7% (FY25-FY28) with operating margins of 25-28%. Near‑term FY26 guidance is low‑to‑mid single‑digit growth with “low‑20s” margins as the Juniper integration work peaks and product rationalization moves forward (HPE Securities Analyst Meeting presentation).

- The Juniper Networks acquisition is closed, and Juniper is central to HPE’s growth strategy. The deal closed July 2, 2025, and former Juniper CEO, Rami Rahim, was appointed President and General Manager of HPE Networking, combining Aruba and Juniper portfolios and go‑to‑market. Rahim knows the enterprise networking market as well as pretty much anyone and his articulation of HPE Networking’s strategy is compelling.

-

Growth is robust

across the portfolio.

In

the quarter ended July 31, 2025, combined Networking revenue was $3.09B,

with campus and branch growing at 28% year-over-year, data center networking

up 78%, routing up 45%, and security up 23%. It’s apparent that the

portfolio now spans campus and branch (including WLAN), DC switching,

routing, and security. Growth projections are much more conservative

through 2028 largely due to integration and product rationalization.

- Networking is a key component of the cloud and AI segments. One of the most interesting opportunities HPE is pursuing with its GreenLake private and hybrid cloud infrastructure is the rapid deployment of the infrastructure needed to build turnkey “AI factories,” particularly sovereign AI data centers. The appetite for sovereign AI factories and LLMs is seemingly insatiable with virtually every developed country developing sovereign AI strategies.

Source: HPE

Securities Analyst Meeting presentation

|

|

What HPE said (and signaled) about enterprise networking

HPE had a lot to say about enterprise networking in its meeting presentation. Given that it was a securities analyst meeting, forecasts and financials were in focus, but implications for the technology markets it operates in, particularly enterprise networking, took top billing. These are the things that should matter to enterprise technology buyers.

Rationalizing operations with new segmentation and a long‑term operating model. HPE simplified reporting to two operating segments – Networking and Cloud & AI – and positioned networking as the larger profit engine through FY28.

Portfolio breadth is now complete. With Juniper closed, HPE presents a full enterprise stack including Aruba (campus/WLAN), Juniper QFX/PTX + Apstra (data center fabrics and intent‑based networking), Mist AI/Marvis (AIOps), Session Smart SD‑WAN, and SRX security, plus HPE compute and storage with GreenLake on top. The combined portfolio is expected to show benefits to both HPE and its customers through simplicity, interoperability, and integration.

Brand and control plane integration and rationalization will come. HPE is operating with two established networking brands in HPE Juniper Networking and HPE Aruba Networking. It has emphasized AI‑native operations on Mist (including Marvis, a “large experience model,” and data center ties into Apstra). Separately, Aruba Central continues to expand with virtual private cloud and on‑prem deployment options for data sovereign environments. Expect both management planes to remain in market for now but a roadmap to rationalization is likely in the longer term.

Integration and product synergies are expected to bear fruit. HPE repeated the estimate of $600M in Juniper‑related synergies by FY28 and a path for networking to account for nearly 60% of HPE’s non‑GAAP operating profit by FY28 (vs. ~50% in Q3 FY25). HPE has gotten quite good at digesting and integrating acquisitions since the 2015 Aruba acquisition, with successful acquisitions including SimpliVity, Nimble Storage, Cray Inc. (supercomputers), Axis Security, OpsRamp, and Morpheus Data. It’s reasonable to expect that HPE is working from an effective M&A playbook.

What it means for the enterprise network vendor market

-

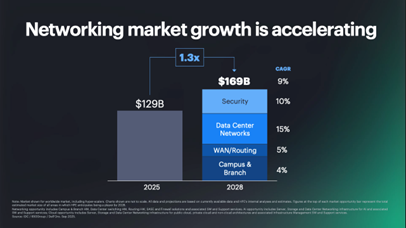

A true #2 challenger across the full stack. HPE now has credible scale from campus/WLAN through DC switching and WAN/routing, with AIOps across the stack. This compresses choice at the top end of the market and intensifies competition with Cisco (enterprise networking market leader) and Arista (hyperscale and high-performance DC leader). HPE’s own slides show the networking total addressable market (TAM) rising from $129B in 2025 to $169B by 2028 with the fastest growth in data‑center networking (+15% CAGR) and security (+10% CAGR), where Juniper has historically been very competitive (HPE Securities Analyst Meeting presentation).

- AIOps is table stakes but differentiation may narrow at WLAN. Mist AI remains a differentiator for now, and HPE is pushing further with agentic workflows and “digital‑experience twins.” However, the US Department of Justice (DOJ) remedy to allow the acquisition to move forward mandates licensing Mist AI source code used in WLAN to competitors, which may erode differentiation over time at the WLAN layer (less so in DC fabrics, routing, or end‑to‑end integration). AIOps is becoming a baseline expectation rather than a meaningful differentiator (HPE Juniper newsroom).

- SMB WLAN market shift. The required divestiture of Aruba Instant On means the simplest Aruba product and deployment option for smaller sites and branches will migrate to a new owner. That reshuffles the SMB channel and could open space for Ubiquiti/TP‑Link (price), Extreme/Fortinet (secure edge), or Meraki (SaaS manageability). Larger mid‑market and enterprise Aruba/Juniper lines are unaffected (Reuters).

- Data center networking momentum gives HPE a DC beachhead. The combined quarterly view shows DC Networking growing at 78% year-over-year in the July quarter with growing demand for AI build‑outs and Ethernet fabrics where Juniper brings depth. Expect more “compute + storage + DC networking” bundles via GreenLake, especially in large sovereign and enterprise AI projects (HPE Securities Analyst Meeting presentation).

- Channel and procurement scale. With Aruba and Juniper partners combined and a broad product suite, buyers should anticipate tighter cross‑sell bundles (e.g. campus + DC + WAN + security), backed by HPE’s larger services footprint. Overlap in campus/WLAN portfolios will likely be rationalized gradually over the mid term, but both roadmaps continue in the near term.

The newly minted HPE Networking is already shaking up the mature and historically somewhat stoic enterprise networking market. That’s not to say that mergers and acquisitions are uncommon in the space, but acquisitions of this magnitude at this time in the technology evolution cycle are certainly less common (the Cisco acquisition of Airespace in 2005 comes to mind). While the mid-large-enterprise networking market remains a virtual oligopoly with a small handful of vendors competing in the space, expect that those vendors will be aggressively pursuing differentiation and market share, but except for some marquee deals, not necessarily competing on price.

Our Take

When a vendor addresses its buying market or its investor market, the question that should always be asked is “so what, what does this mean to me?” It’s difficult to sift through all the noise and get down to why you should care and what you should do about it. Info-Tech recommends the following:

-

Stabilize today, negotiate for tomorrow.

- Protect your installed base. Ask HPE for written support horizons and end‑of‑sale or convert‑to migration paths for any overlapping campus/WLAN and branch product lines. Lock in software entitlement portability (Aruba Central ↔ Mist AI where feasible) and like‑for‑like trade‑ups if lines are consolidated. While HPE has not announced abrupt sunset plans and has signaled that FY26 is about integration, not disruption, start the discussion sooner rather than later.

- Use the integration window as negotiation leverage. FY26 guidance implies HPE is prioritizing integration and margin discipline. Ask for multidomain discounts (campus + DC + WAN + security) and GreenLake incentives where applicable. HPE is signaling networking as a profit engine and will compete for share.

-

Plan your control/management

plane.

-

If you’re

Aruba‑centric

(Central). The

virtual private cloud (VPC) and on‑prem options provide a compliant path

for sovereign or air‑gapped environments, which is a compelling reason to

stay with Central in regulated sectors.

-

If you’re

Juniper‑centric

(Mist). The

securities analyst meeting and subsequent releases emphasize agentic AI

with Marvis AI, large experience models (LEMs), and Apstra IBN integration

as a clear path for AIOps from network edge to DC. Look for published

migrations and integrations (e.g. identity, observability, ticketing) with

HPE OpsRamp and GreenLake Intelligence.

-

If you’re

multivendor.

Expect

better “northbound” integrations (ServiceNow, collaboration apps) from

Mist AI. Aruba Central is expanding heterogenous monitoring via OpsRamp.

Align on the system of record for incidents, configurations, and service

level objectives (SLOs) to avoid “split‑brain” ops.

-

If you’re

Aruba‑centric

(Central). The

virtual private cloud (VPC) and on‑prem options provide a compliant path

for sovereign or air‑gapped environments, which is a compelling reason to

stay with Central in regulated sectors.

- Develop an SMB and branch strategy. If you standardized on Aruba Instant On, consider a contingency plan. Confirm the buyer of Instant On (once named), HPE’s support and firmware timelines, and authorized distribution and channels. Avoid large new Instant On rollouts until post‑divestiture roadmaps are public, and consider Aruba enterprise AP/Switch lines, Juniper EX/AX, or other SMB alternatives for new sites.

- Consider data center network modernization. For AI and cloud fabrics, consider adding Juniper QFX + Apstra to the shortlist with HPE’s compute/storage bundles. The near‑term growth spike in DC networking suggests supply and services attention, but lock in lead times, validate designs (front‑ and back‑end Ethernet), and review liquid cooling readiness, as applicable.

- Evaluate security architecture alignment. Expect more networking security convergence across network access control (NAC), firewall, and SSE/SASE. If you run ClearPass or another NAC today, map integration points to Juniper security and to third‑party SSE if you’re not all in on HPE.

-

Contractual

levers to insist on now.

-

Price

protection

through

integration milestones (12-24 months).

-

Cross‑grade

rights

(Aruba ↔ Juniper

equivalents) with no penalty.

-

AIOps

outcomes in SLAs,

including

mean time to repair (MTTR) reductions, ticket deflection/resolution, and

user experience SLOs (not just device uptime).

-

Lifecycle guarantees

of a minimum of five

years TAC support and spares for any infrastructure you buy in FY26.

-

Price

protection

through

integration milestones (12-24 months).

There are always going to be things to watch after an acquisition and it’s important to have contingency plans for changes that may be detrimental to your organization. It’s difficult to consider all the possible risks and impacts, but consider the possible integration risks across systems, channel, and portfolio. While HPE was quite deliberate when speaking about digesting and rationalizing the Juniper and Aruba portfolios, monitor product roadmaps, overlap, and strategy closely. Keep an eye on the rapidly evolving AIOps market and determine if differentiation is eroded once Mist AI is licensed to other vendors. There’s a lot to digest for the buying market and especially existing HPE Aruba and Juniper customers.

Bottom line

HPE used the 2025 securities analyst meeting to put a clear stake in the ground: Networking is the company’s core profit engine, and the Juniper acquisition gives HPE credible scale and AIOps depth from campus to data center. The near term is about clean integration, while the medium term is about product mix, synergies, and cross‑domain bundles. For buyers, this is an opportunity to consolidate vendors without giving up feature depth, but it’s also the time to lock in protections and choose an AIOps control plane path aligned to your governance model. Seek to negotiate better economics and raise the bar on operational outcomes.